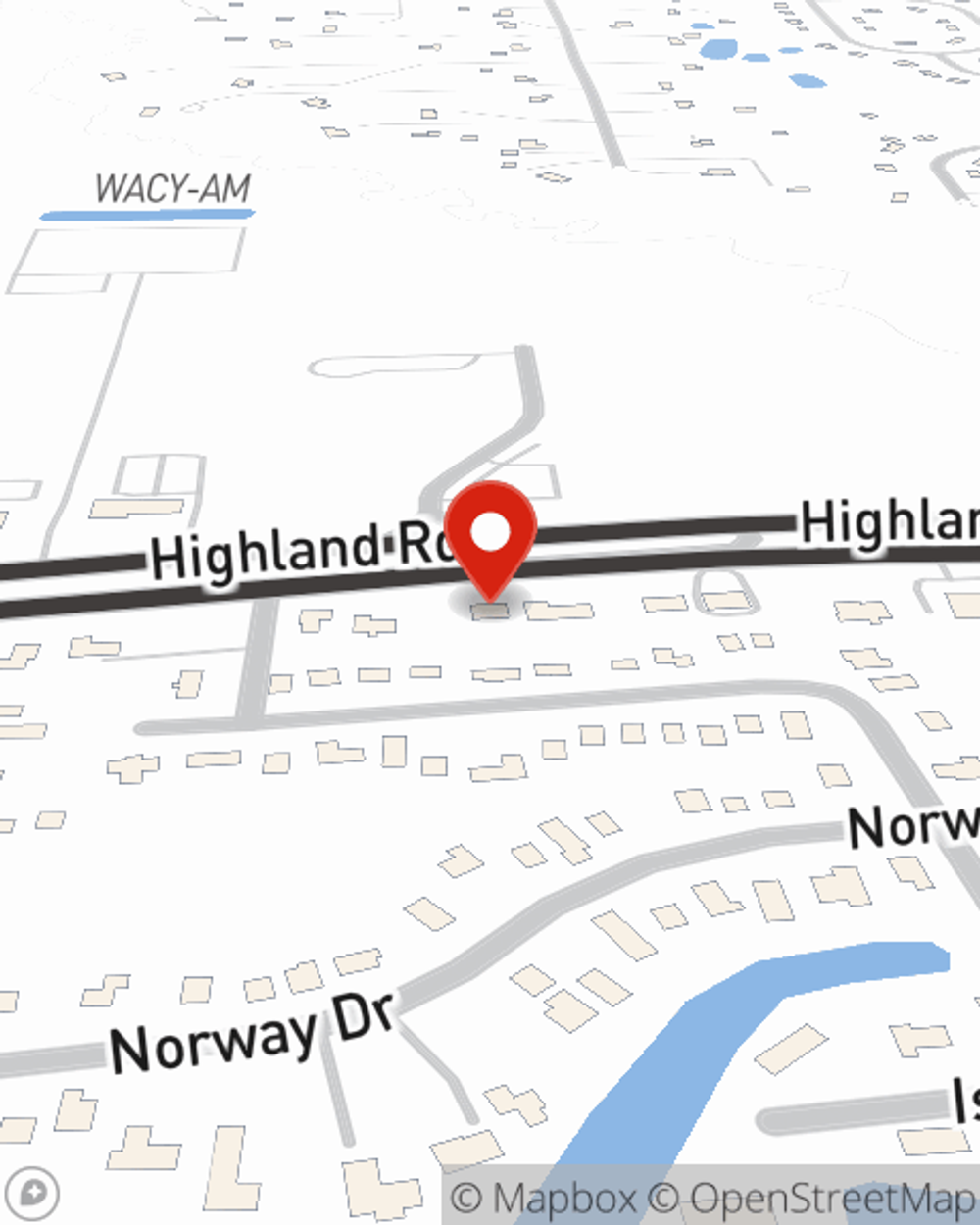

Renters Insurance in and around Hartland

Your renters insurance search is over, Hartland

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It may feel like a lot to think through your sand volleyball league, your busy schedule, work, as well as deductibles and providers for renters insurance. State Farm offers hassle-free assistance and incredible coverage for your cameras, sound equipment and home gadgets in your rented property. When mishaps occur, State Farm can help.

Your renters insurance search is over, Hartland

Renting a home? Insure what you own.

Why Renters In Hartland Choose State Farm

Renters insurance may seem like not a big deal, and you're wondering if having it is actually beneficial. But pause for a minute to think about how much it would cost to replace all the stuff in your rented apartment. State Farm's Renters insurance can help when fires or break-ins damage your valuables.

As a value-driven provider of renters insurance in Hartland, MI, State Farm helps you keep your belongings protected. Call State Farm agent Brad Charles today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Brad at (810) 632-2300 or visit our FAQ page.

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Brad Charles

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.